Warganet – The profession is one of the many factors that use the insurance supplier assumed premium fees, suggest that the drivers can have greater effects than before.

So, what is the best occupation for a low car insurance and a job that can be more expensive? Our guide is to provide what you need to know, including a list of a car insurance profession limits the best and worst work to cover.

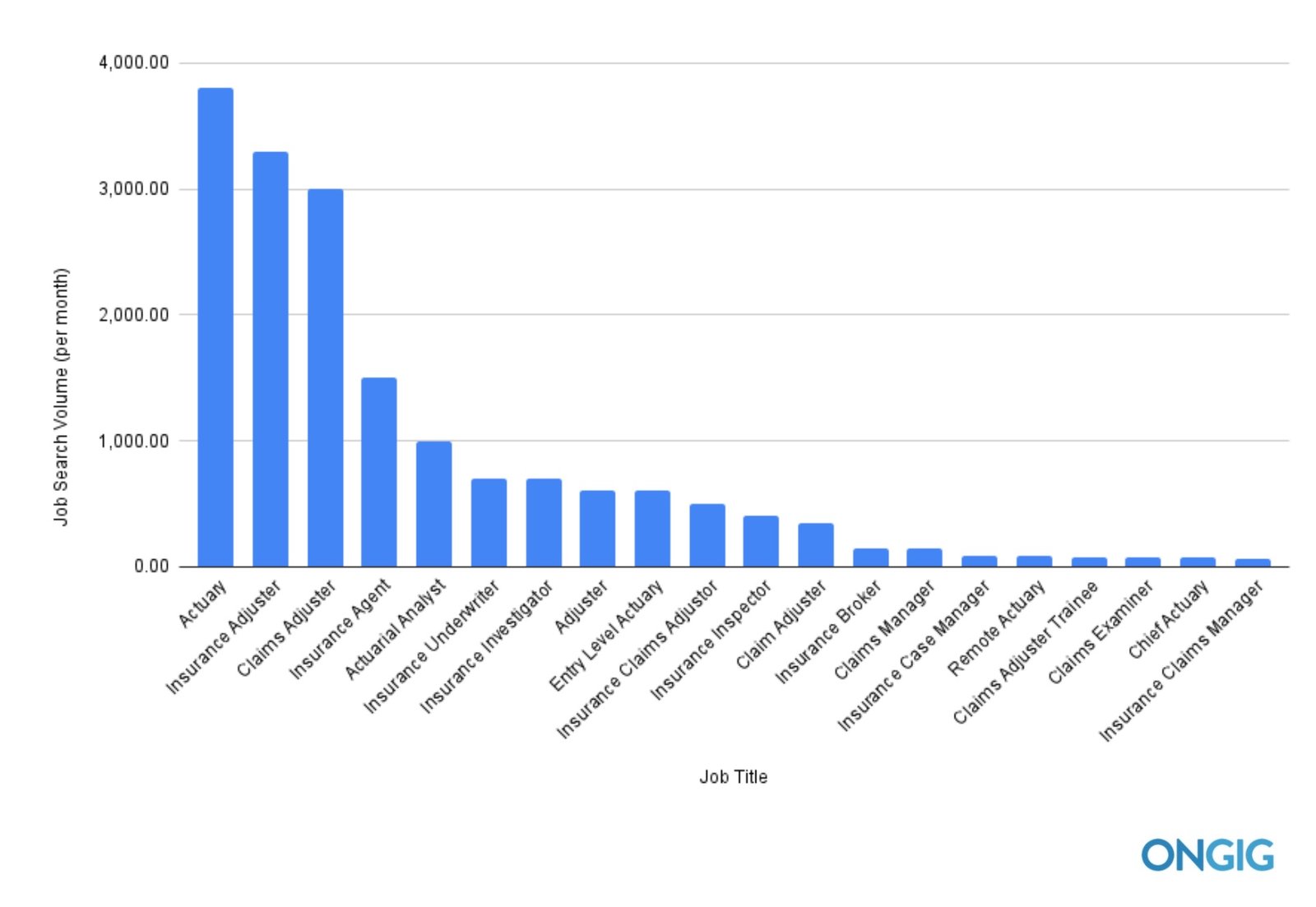

Insurance Job Titles

The car insurance company is often asking you to give you a job status and job title when you apply the cover.

We’re Hiring! Job Title: Executive/ Sr. Executive/ Assistant Manager/ –…

Although it is not like that to calculate the premium, the possibility of the policy can be affected by the information provided.

Some occupation can lead to lower premiums, while others can be more expensive, so if you may match some of your job details, important to test a different title.

When calculating the cover cost, the car insurance company represents the job and how do you make your job (if you spoke your job or if you save your expensive tasks in your car).

On average, they will also consider the number of travelers, which can also affect the payday costs paid.

Reliable Nepal Life Insurance Limited Job Opening

It is important to remember – whether you think it is fair or not – the insurance supplier determines the basic value of the relevant statistics (instead of the most accurate way to do so.

Segment is one of the lowest slaves for insurance, but also looks like many other government sectors – or around – the lower job is visible.

These include Magistrat, Head of Teacher and cross school (unknown as a lollipop and woman), which usually costs the average car insurance compared to other car professions.

The retirement driver is usually developed with low car, because it is considered less experienced experience on the road, bonuses that cannot be bonuses, and it is not working for work or travel. No need

Find Out Why Your Job Impacts The Cost Of Car Insurance

The English is retired in England now 655 years old, and you may know that the car insurance is more than 50s less than the cover for another. Retires to wear up to 50 or older, so it can cause lower premium.

This is because the retires are usually more experienced drivers, but they may not have to travel for business or travel purposes for travel, more likely reduce premiums.

Get quote here for a retired or more learning car insurance is more about guiding for a guide for more experienced motorcycles at 60 and 70 years.

Data claim the car before showing the nurse is more likely to claim the policy compared to almost all the profession. It is supposed to appear as low-risk nurse drivers, which results in lower premium results as a result of the turn.

How Much Does Your Job Title Impact Your Car Insurance Costs?

Many car insurance companies will also offer an offer for NSS employees, so you should buy exclusive discounts before they take place to policy.

Secretary of Medical, Secretary Legal and Personal Assistant Everything is available at 10 low jobs for the English car insurance, according to this money.

The reason for this is ready to explain, but it should be a secretariat role to be more likely to obtain affordable cover than the people in many other work titles.

If you are still secretary and you are looking for affordable cover, compare quotes here to see how much you can save:

Insurance Rater Job Description And Career Path

For the police officer, the car insurance is usually lower than covering the proportion of profession, which is in the case of nurses as well as claimed that they get private car insurance policy instead of other drivers.

According to the insurance description website, the fact of the police “spends daily to keep the law” and thus “it is more likely to drive because she is more time for a patrol vehicle.

Also list the Coast Gard is one of the cheap jobs for the English insurance and some car insurance companies will give you a coast concessive as part of the emergency service.

There is also a special plan that is known as a blue light scheme, where you work in emergency services and armed forces in some cases that there will be different contracts, including car insurance.

Decoding How Job Title Impact Car Insurance Costs(2025)

Compare with Coats UK here earned car insurance quote with us here and find a cheap policy for you within minutes:

It can be difficult to get a headache at the end of the logic at the end of the most expensive work for car insurance, because the list is good, random.

The new study has indicated that the most expensive job for car insurance includes fruit options, workers, painters and painters, while other premiums football players.

Pro Play football is well-known for high car accidents and therefore are punished for higher insurance expenditures, but the salary is more likely to cover the cover of a week. So, relate to the amount you get, the insurance price may not be dangerous.

Calendar • Sun Life Health Hiring Event

For the unemployed driver, the car insurance is usually more expensive than the UK average, due to the BBC survey that describes that the unemployed driver is paying for about 30% more than one to cover another. Paying a higher premium at that time, if it seems to be unable to carry, but the price is based on previous years and events and statistics events.

The following features the most expensive job title for car insurance in the UK Infographic:

– But you can do anything to improve the chances of getting better dealings.

When you enter the details for the car insurance coat, if you have a label over one label in your profession, try the Tweet job title. You may be surprised by the premium rate you prefer, but remember to be honest – deceive your profession cannot delete your insurance.

Erie Insurance Group Jobs & Careers

No reason not to try to explain your work by differently by tweeting a particular situation to get better car insurance agreement in the future.

For example, ‘artist’ down to the job title as ‘painters’, which admits that you are a nurse when you are a racing car drivers? It is not good to be considered as a form of fraud and insurance should be canceled by demanding.

According to the comparison of the car title of car to the experts in the experts, if you pay $ 500 to the public cover, you can save your title as ‘artist’ as ‘Painter’! How to try and tested – give me once and you can investigate the low cars today.

Last, we can not obey enough stress, if it is important to compare the to-date insurance, the best way to find a cheap contract and you can do it by tapping the green button below ::

9 Insurance Resume Examples For 2025

The Dvla news has opened the new DVLA digital car renewal system has launched a new online system that improves the UK to update the car tax and get a replacement logbook of V5C while disappearing. Read more … when deciding on the cost of car insurance, insurance analyzes each inch personal details to work with a traffic collision. The study shows that the profession can produce insurance rates. The insurance agency consider some profession to be risen than the rest. However, there is no connection between the high-risk project and causes more crash, so this risk analysis method is at least controversial.

Car insurance agencies to recognize the most considerable tasks, so the insured carists, the car experts took the car to benefit insurance quote when changing the details

To create a car insurance quote, we have used data from the National Statistics (Ounce), BBC and Statissa to bring the UK average driver. They usually do the Volkswagen Golf, travel 7, 600 miles each year, having a large car insurance cover and no accident before.

Then we signed the details of 100 times the biggest car comparison websites, each time only changes the role of the job. Then show us a filled job. (**)