Warganet – This is a digest about this topic. It is a collection of different blogs that discuss. Each title is associated with a original blog.

Writing writing is a process that insurance companies use to evaluate the risks associated with a particular person’s insurance or tool. The writing process includes collecting information on policy owners, analyzing the information and then providing coverage and making decisions at any cost. On the other hand, the direct payment on the other hand refers to the total amount of payments collected by the insurance company from policy owners over a period of time. Understanding between text writing and direct text is important to understand how insurance companies work.

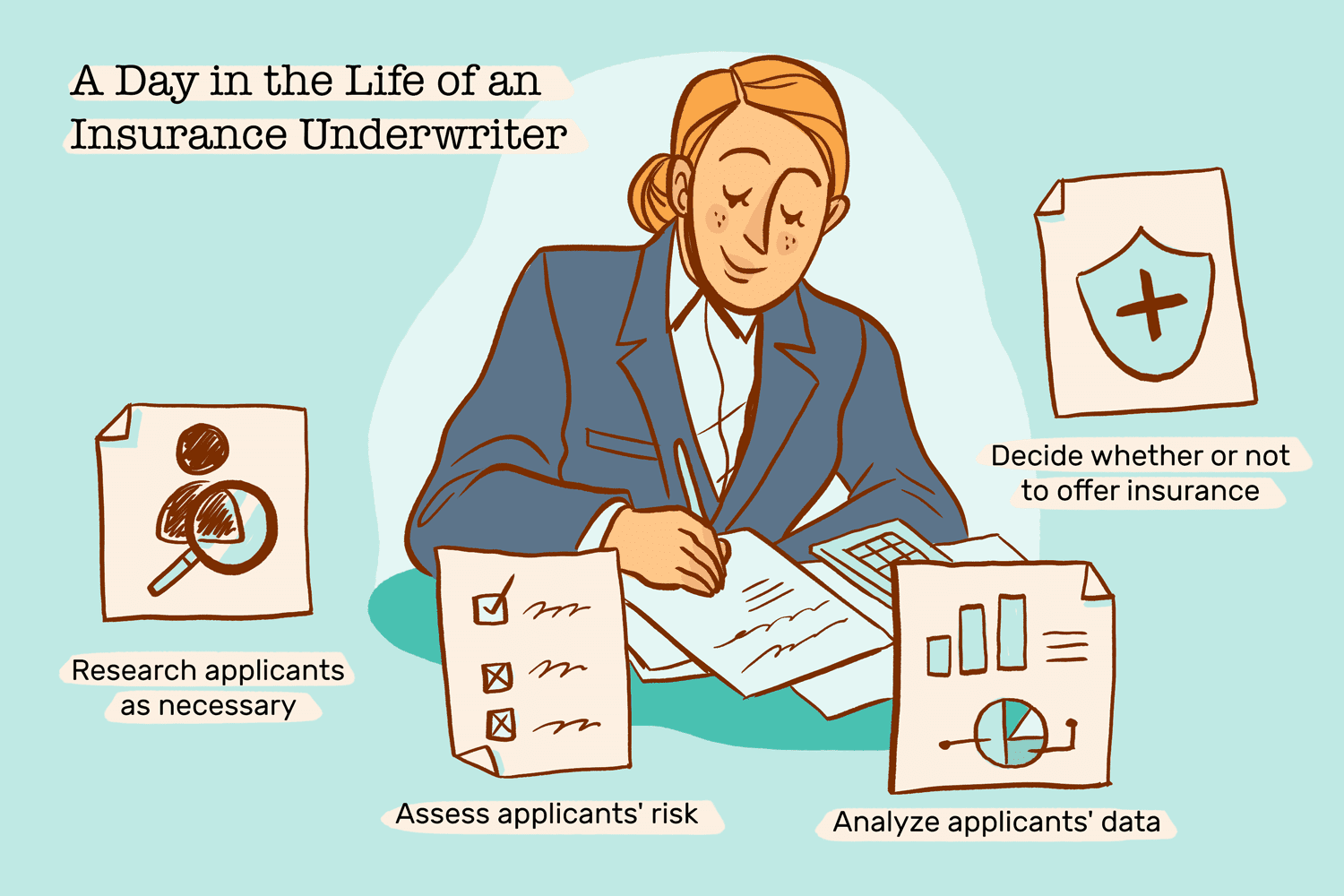

Insurance Underwriting

:max_bytes(150000):strip_icc()/UnderwritingRisk_Final_4187416-e3579cf6abcf446b8af92c3337b35e5c.jpg?strip=all)

The writing process includes evaluating the risk associated with the insurance of a particular person or tool. This process includes collecting wide information including their age, gender, work, health status, credit score and driving records regarding policy owners. The insurance company will also evaluate the risk related to the specific type of coverage issued. For example, an insurance company that distributes a car insurance will focus on repairing the car and model, the driver’s age and the history of driving and the location of the car in which the car is driven.

How Does The Life Insurance Underwriting Process Work?

There are several reasons to consider insurance companies when making writing decisions. This includes the age of policy owner, gender, work, health status, credit score and running records. Insurance companies will also focus on the type of vaccine and the risk associated with the vaccine. For example, a policy -owner who wants life insurance may be less complicated by a more complex writing than a policy owner seeking a car insurance.

Direct payments in the text refer to the total amount of payments collected by the insurance company from policy owners at a particular time. This image is an important metric for insurance companies, as it shows the overall health of their business. Written payments can be affected by various factors, as well as changing the quality of writing, changes in general economy and changes in consumer behavior.

The writing process plays an important role in determining the direct payment written by the insurance company. By reviewing the risk associated with the insurance of a particular person or entity, insurance companies can determine the correct payment payment for the policy issued. If the insurance company is very clear in its writing standards, it can complete the principles of writing to people or entities that are at high risk of claiming. It can pay high demand for an insurance company and result in minimal gains. By contrast, if the insurance company is very strictly in its writing values, it may miss policy owners and create a direct payment in writing.

Good writing writing is essential for the success of the insurance company. By properly evaluating the risk and determining the appropriate payments, insurance companies can create a high direct payment and improve their profits. However, good writing requires caution in the evaluation of policy owners and to be very effective. Insurance companies must be prepared to adjust to their writing values in response to market conditions and consumer behavior.

Underwriting: Why Different Underwriters Quote Differently

Understanding between text writing and direct text is important to understand how insurance companies work. By properly evaluating the risk and determining the appropriate payments, insurance companies can create a high direct payment and improve their profits. However, good writing requires caution in the evaluation of policy owners and to be very effective. Insurance companies must be prepared to adjust to their writing values in response to market conditions and consumer behavior.

The writing cycle is an important part of the deployment of capital. The writing cycle refers to the time when insurance companies, banks and other financial institutions evaluate and accept the risk. During this cycle, these organizations evaluate the risks and rewards of credit, insurance policies and other financial services. The writing cycle is important for investors to understand, as it helps them make their capital more information and where to invest.

1 stages of writing cycles: Writing cycle consists of four different stages: a) Introduction, b) increase, c) maturity and d) reduced. Each step offers unique challenges and opportunities for investors. In the introductory stage, new products and services are introduced to the market and investors must evaluate the risks and rewards of these new versions. In the growth phase, the demand for these products and services increases and investors must decide how to promote this growth. In the maturity stage, the market is full and investors must look for ways to separate themselves from their competitors. Finally, during the fall season, the demand for these products and services is reduced and investors must decide whether to leave the market or invest in the hope of restoring the market.

2 Importance of Risk Management: Risk management is an important part of the writing cycle. Investors must evaluate possible risks associated with their investment and promote strategies to reduce these risks. For example, investors may choose to convert their portfolios to reduce the impact of one investment on their total income. In addition, investors can choose to invest in wealth and a brief overview such as securities or real estate to reduce the impact of market absence.

How Digital Underwriting Helps Your Insurance Business Grow?

3 Introduction to Statistical Analysis: Data analysis is increasingly important in the writing cycle. Investors can make more information on where to set up their capital by analyzing data on consumer behavior, economic trends and market conditions. For example, data analysis can help investors identify emerging trends and opportunities, such as e-commerce growth or increased renewable energy.

1. Effects of economic conditions: Economic conditions play an important role in the cycle of writing. During economic growth, demand for financial services increases and investors may be more interested in taking a risky investment. Instead, during the economic downturn, the demand for financial services can be reduced and investors may be more vulnerable. It is important for investors to understand this economic trend, as it can help them make informed decisions on where to send their capital.

5. Control Introduction: Control is another important factor for the cycle of writing. Legal changes can have a significant impact on the market, as they can affect loan availability, capital use and general investment profile. Investors must be informed about these legal changes and accordingly they need to adjust their strategies.

The writing cycle is important to make the right decision on where investors will be capital in their capital. Investors can develop strategies by analyzing the phases of the writing cycle, risking the data, getting data analysis, focusing on economic conditions and understanding the legal changes that are well set to fund market opportunities and reduce possible risks.

The Underwriting Process In Insurance Infographic Template

Insurance writing is a process in which insurance companies evaluate the risk of insurance for a particular policy owner or policy owner. The cycle of writing is a natural process that takes place in the insurance industry and is reflected by the profit period and then after the decline period. The writing cycle is also important for insurance professionals and policy owners, as it can have a significant impact on the availability of insurance and cheap coverage.

The cycle of writing is a natural process that takes place in the insurance industry. It has an alternative time of profitability, known as a complex market and a reduced profit, is also known as a soft market. During the complex market, insurance companies increase payments, tighten the writing values and reduce coverage options to maximize profits. By contrast, during the smooth market, insurance companies reduce low payments, open up writing standards and expand coverage options to continue to be competitive.

Several factors, as well as episodes, economic status and legal changes, affect the cycle of writing. Disaster cases such as hurricanes, earthquakes and fires can have a significant impact on the cycle of writing by increasing the number of claims and reducing access to relapses. Economic conditions such as inflation, interest rates and unemployment can also affect the frequency of writing by affecting insurance requirements and requirements. Legal changes, as new rules and regulations, can also affect the frequency of writing by changing the legal environment in which insurance companies operate in legal environment.

The consolidation insurance industry plays an important object and an important role in the writing cycle. Re -designing helps spread the risk of catastrophic events between insurance and many insurance for insurance companies. During the complex market, rewagating is more expensive and not available, which can reduce access to insurance coverage. For comparison, during the smooth market, the relapse becomes more expensive and more accessible, which can lead to the expansion of coverage options.

Smart Underwriting System: An Intelligent Decision Support System For Insurance Approval & Risk Assessment

Different events like hurricanes, earthquakes and fires are a major expansion of the writing cycle. These events can reduce growth and return to claim, thus increasing insurance companies, enhancing the value of writing and reducing vaccination options. Epically cases can increase insurance coverage requirements, which may add more impact. (*)